Wellworks For You is a digital success for Sandia

Innovation arrived in the form of a simplified Employee Health & Wellbeing program in fiscal year 2025.

For the past 10 years, employees and spouses enrolled in a Sandia Health Plan could manage their well-being and earn up to $500 annually toward their Health Reimbursement Account or Health Savings Account by participating in a variety of wellness activities on the platform and accumulating points.

Despite the digital wellness provider’s best efforts, the platform was underused.

Employee feedback reported that the platform was overly complicated and time-consuming to use. As a result, 40% of eligible participants regularly engaged, and 30% earned their entire $500 reward. Additionally, the platform didn’t incorporate Sandia services or content from health coaches.

Not satisfied with the status quo, Employee Health & Wellbeing looked for a new, simpler digital platform provider that would offer employees the same health dollars toward Health Reimbursement Accounts and Health Savings Accounts, allow for more customization of wellness programs and feature valuable content developed by Sandia coaches. In short, the team felt the platform should support health education, not work apart from it.

Enter Wellworks For You.

“We chose Wellworks because it is easier to use and has a simple three-step process for earning incentive dollars,” Health Care and Medical Clinic manager Johanna Grassham said. “It includes a health assessment developed in-house, guiding users to our services, and allows us to take advantage of our health coaches by posting their educational materials on the platform.”

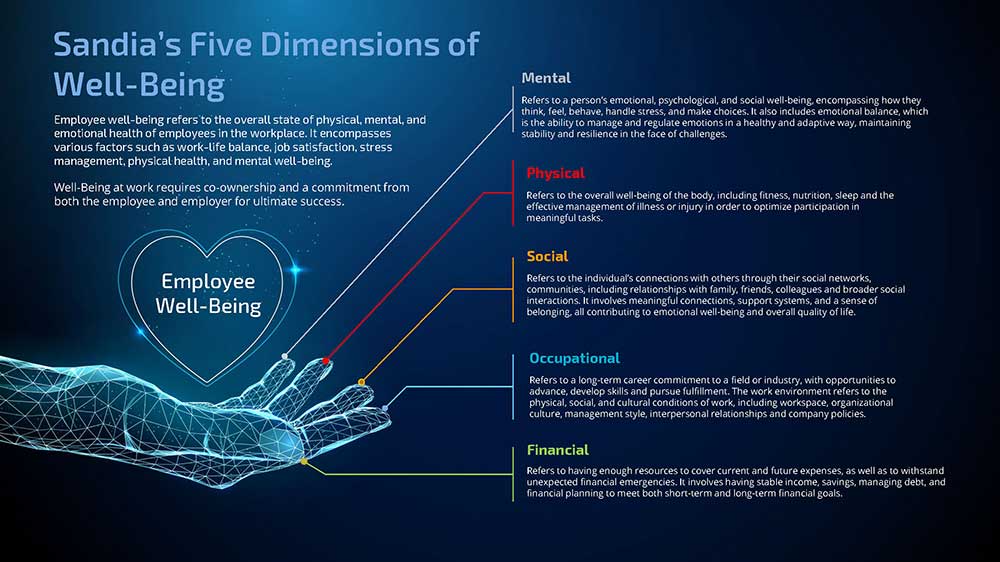

Johanna, health educator Angelique Crandall and registered dietitian Lisa Teves spearheaded the switch to Wellworks, which furthers Employee Health & Wellbeing’s mission to educate, guide and provide resources for Sandians. The move aligned with emphasis on Sandia’s Five Dimensions of Well-Being.

Now, rather than having to use a complex, quarterly points system for financial reward, employees can earn the same $500 toward their health accounts in three easy steps throughout the year: watching the Wellworks for You navigation video, filling out a health assessment and completing a Health Action Plan on the platform.

Additionally, staff who may not have been focused on their well-being for the full year can still earn their full health account dollars before the end of the fiscal year. Users can also continue to track steps, sleep, eating habits and more, but they aren’t required to track that data for financial reward.

Wellworks gives Sandians a much easier platform to navigate and features the extensive well-being information that Employee Health & Wellbeing has created. The team estimates the move to Wellworks will save Sandia nearly $1 million in its first year, even with platform implementation fees.

Transforming into a well-being organization

In 2024, Sandia introduced several new and enhanced employee benefits. First, the Labs introduced two new floating holidays. All eligible employees receive two floating holidays, a total of 16 hours, at the beginning of the calendar year. Part-time employees receive prorated hours based on their standard hours.

Last year, Sandia increased employees’ vacation time by revising its accrual schedule. Now, employees’ accrual rates will increase at the start of their third, fifth, 10th, 15th and 20th service years. The accrual frequency also increased from 24 to 26 times per year.

The Labs also introduced a new $1,500 employer-sponsored childcare fund to assist employees with childcare costs during business hours. The fund provides $1,500 to each eligible employee in an after-tax account at the start of each calendar year.

Sandia expanded eligible expenses for the Lifestyle Spending Account. Now, the account covers additional eligible expenses, such as music subscriptions, meditation apps and salon and barber services.

Lastly, the Labs enhanced the 401(k) plan by introducing a student loan debt match program. Now, eligible student loan payments qualify for matching contributions in Sandia’s 401(k) plan, up to the maximum of 66.667 cents of every dollar, up to the first 6% of the employee’s eligible compensation. This includes the employee’s own student loans, as well as cosigned or parent loans.