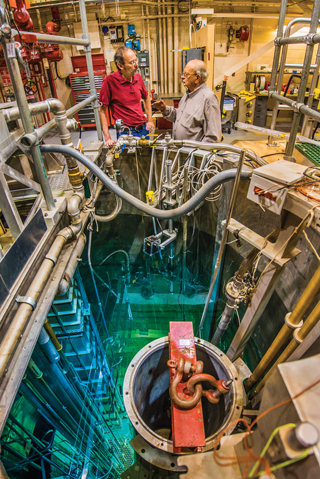

Dick Coats, right, Eden Radioisotopes’s chief technology officer and a retired Sandian, talks science with nuclear engineer John Ford (1381) at the Annular Core Research Reactor, where they helped develop a molybdenum-99 reactor concept in the 1990s. Eden recently licensed the technology with the goal of producing a US supply of moly 99 for use in nuclear medicine. (Photo by Randy Montoya)

An Albuquerque startup company has licensed a Sandia technology that offers a way to make molybdenum-99, a radioactive isotope needed for diagnostic imaging in nuclear medicine, in the United States. Known as moly 99 for short, it is currently made in aging, often unreliable nuclear reactors outside the country, raising concerns about future shortages.

Eden Radioisotopes LLC was founded last year and licensed the Sandia moly 99 reactor conceptual design in November. It hopes to build the first US reactor for the isotope and become a global supplier. “One of the pressing reasons for starting this company is the moly 99 shortages that are imminent in the next few years,” says Chris Wagner, Eden’s chief operating officer and a 30-year veteran of the medical imaging industry. “We really feel this is a critical time period to enter the market and supply replacement capacity for what is going offline.”

Moly 99 is the precursor for the radioactive isotope technetium-99m used extensively in medical diagnostic tests because it emits a gamma ray that can be tracked in the body, letting physicians image the spread of a disease. And it decays quickly so patients are exposed to little radiation.

Moly 99 is made in commercial nuclear reactors using weapon-grade uranium and 50 to 100 megawatts of power. Neutrons bombard the uranium-235 target. The uranium fissions and produces a moly 99 atom about 6 percent of the time. Moly 99 is extracted from the reactor through a chemical process in a hot cell facility and used by radiopharmaceutical manufacturers worldwide to produce moly 99/technetium-99m generators. The moly 99, with a 66-hour half-life, decays to technetium-99m, with a six-hour half-life. The generators are then shipped to hospitals, clinics, and radiopharmacies, which make individual unit doses for a variety of patient imaging procedures.

“It’s a $4 billion a year market,” Wagner says. “There are 30 million diagnostic procedures done worldwide each year and 80 percent use technetium-99m. More than 50 percent of the procedures are done in the United States, and 60 percent of those are cardiac related. This issue is very important to US health care because there is no domestic production supplier on US soil.”

Meeting the moly demand

The world’s five primary moly 99 production reactors, in Canada, the Netherlands, South Africa, Belgium, and Australia, are often unpredictably closed for repairs, causing periodic shortages that can last months, Wagner says. Two of the largest, the Canadian and Dutch, could either stop producing moly 99 or be decommissioned in the next 10 years. “They represent more than 60 percent of the global supply,” Wagner says. “There is a new reactor due in France, but at the end of the day, if the two go offline and new replacement capacity comes on, Eden still predicts a 20 to 30 percent global shortage to meet today’s demand.”

A search has been on for a number of years for a way to make moly 99 in the United States without using weapon-grade uranium. Several companies have explored new kinds of reactors and different methods to produce the isotope but are not yet in commercial production. “Eden would be the first reactor in the US specifically for medical isotope production,” Wagner says. “We feel that science-wise, this has the most potential for success in the market.”

Dick Coats, Eden’s chief technology officer, is a retired Sandian who helped develop the moly 99 reactor concept at the Labs in the 1990s. “I’ve been involved in reactors my entire career,” says Coats, who has a PhD in engineering sciences from the University of Oklahoma and worked at Sandia 35 years.

Based on technology developed in the DOE-funded Sandia medical isotope production program of the 1990s, the team created a reactor concept tailored to the business of producing moly 99. “This reactor is very small, less than 2 megawatts in power, about a foot-and-a-half in diameter and about the same height, but very efficient,” Coats says.

The reactor sits in a pool of cooling water 28 to 30 feet deep. It has an all-target core of low-enriched uranium — less than 20 percent U-235 — fuel elements. “The targets are irradiated and every one can be pulled out and processed for moly 99. The entire core is available for moly 99 production,” Coats says. “Every fission that occurs produces moly. The reactor’s only purpose is medical isotope production. This is what is new and unique. Nobody thought about approaching it that way.”

Ed Parma (1384), who was on the original Sandia team, says the world demand for moly 99 can be met with a small, all-target reactor processed every week. He says larger reactors aren’t cost effective because they use so much power to drive the targets. “They’re using 150 megawatts to drive a 1 megawatt system,” he says. “When you add in fuel costs, operations, and maintenance, it’s hard to make money.”

He says there has never been a reactor system designed just to make moly 99. “They all started as something else,” he says. “Our design is scaled down to just the production of moly. The reactor is only the size you need. It’s more efficient and economically viable.”

Completing a mission

The Eden reactor is based on a Sandia reactor concept that was envisioned but not designed. The Sandia team went on to other projects in the late 1990s. After he retired in 2011, Coats was asked to join Eden by company partners including CEO Bennett Lee, who learned of the technology while an intern in the Sandia licensing group.

“The reactor had been on my mind for many years,” Coats says. “It’s very exciting to be part of the effort to commercialize it. I don’t view this so much as trying to produce a successful business venture as to complete a mission. There’s more an emotional aspect than economic. It’s something we can do for the country.”

Eden is raising investment capital. The cost for initial funding through production is about $75 million.

It hopes to be in production in about four years. During that time it will build the reactor and facilities and seek licensing from the Nuclear Regulatory Commission and approval of the manufacturing process from the Food and Drug Administration. Wagner says the preferred location is Hobbs, N.M., which has a workforce familiar with nuclear activities due to the nearby URENCO USA uranium enrichment facility. Eden would employ about 140 people.

“Our intent is not to make something just for the United States,” Wagner says. “We will be US-based so US health care has domestic coverage. But our production capacity will be enough to meet the entire global demand.”

All the bases covered

On the business side, two companies provide 100 percent of US production and distribution of moly 99/technetium-99m generators: Mallinckrodt Pharmaceuticals in Missouri and Lantheus Medical Imaging in Massachusetts. Wagner is a former Mallinckrodt vice president and Eden advisory board member Peter Card is a former Lantheus VP. On the technical side, Coats is joined in the company by Milt Vernon, also a retired Sandian who worked on the technology. “We have all the bases covered to be successful,” Wagner says.

Bob Westervelt (7932) says Sandia pursued an exclusive license for the technology. “We didn’t want multiple people trying to build it,” he says. “We wanted one company that could actually commercialize it.”

The licensing department advertised it last summer, and interested parties had to demonstrate they had the financial resources and technical capabilities to build the reactor and get regulatory and environmental approvals.

“There were 10 responses and only one, Eden, came with a full package proposal,” Bob says. Eden was given an exclusive license for the term of the patent, which is pending.

“It’s very exciting to be part of a project that could be commercialized,” Ed says. “I think this is the future. There’s no doubt in my mind.”