Understanding congestion and cascades in exchange systems

Modern economies depend on efficient and reliable financial markets. Critical to the smooth functioning of these markets are a set of trading, payment, clearing and settlement infrastructures. Financial infrastructures are formed by a large number of technological and institutional components that interact within complex networks. Congestion in a payment system is both a cause and a consequence of reduced transfer capacity

We conducted a series of analyses with the goal of understanding how congestion arising from this stress is influenced by two control parameters: the global liquidity level and the conductance of a global liquidity market. More specifically, our objectives included identification of the basic parameters that control the quality of operation of payment systems, characterization of the problems that can arise when performance degrades, identification of the effects of coupling among payment systems and how different policies influence their performance.

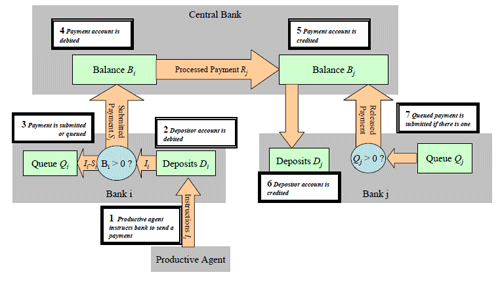

Loki Transact allows us to evaluate liquidity and credit risks in the context of interdependent interbank payment systems interlinked through foreign exchange transactions. Further interdependence is created by a Payment versus Payment (PvP) constraint that links the two legs of the foreign exchange transactions. Using this model, the team identified conditions under which payment settlement in the two systems becomes correlated and showed that large credit exposures can be generated as the result of liquidity pressures in one of the two systems. PvP can eliminate this credit risk but creates a new interdependence by making settlement of payments in both systems dependent on the level of liquidity available in the other system.

Journal Papers

- The Payments System and the Market for Interbank Funds, Part 4 in New Directions for Understanding Systemic Risk, FRBNY Economic Policy Review, November 2007

- Congestion and Cascades in Payment Systems, Physica A, 15 Oct. 2007; v.384, no.2, p.693-718 (PDF 1.3MB) (Online version)

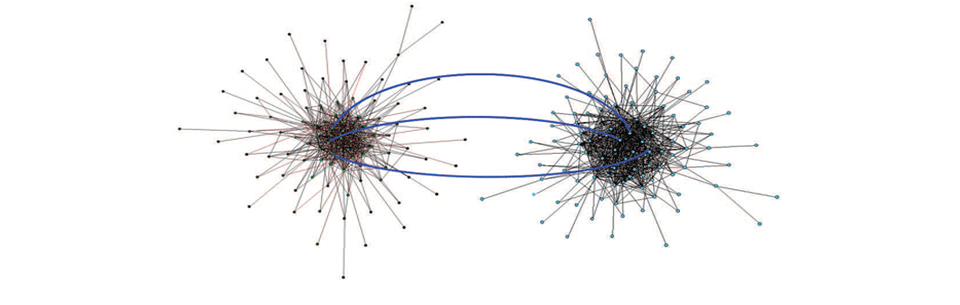

- The Topology of Interbank Payment Flows, Physica A: Statistical Mechanics and Its Applications, June 2007; vol.379, no.1, p.317-33.

Reports/Symposia

- Congestion and Cascades in Interdependent Payment Systems, Sandia National Laboratories report, March 2009

- Performance and resilience to liquidity disruptions in interdependent RTGS payment systems, Joint Banque de France / European Central Bank conference Liquidity in interdependent transfer systems, Paris, June 2008

- New Approaches for Payment System Simulation Research, Bank of Finland conference proceedings, 2007

- Congestion and Cascades in Coupled Payment Systems, Joint Bank of England/European Central Bank Conference on “Payments and monetary and financial stability”, November 2007

- Congestion and Cascades in Coupled Payment Systems, 5th Payment and Settlement Simulation Seminar and Workshop, Helsinki, Finland, August 2007

- Congestion and Cascades in Payment Systems, Federal Reserve Bank of New York Staff report, September 2006

- The Topology of Interbank Payment Flows, Federal Reserve Bank of New York Staff Reports, no. 243, March 2006

Presentations

- Congestion and Cascades in Payment Systems, 4th Payment and Settlement Simulation Seminar and Workshop, Helsinki, Finland, August 2006

- Network Topology and Payment System Resilience – first results, Bank of Finland seminar and workshop, August 2006

- Network relationships and network models in payment systems, Bank of Finland seminar and workshop August 2005

- Modeling Banks’ Payment Submittal Decisions, Bank of Finland Payment and Settlement Simulation Seminar & Workshop, August 2005